| | Meanwhile, ETH is gaining ground fast as CME futures activity flips in its favor. | ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ | View in browser | | | | Mining Weakness Tests Bitcoin's Current Market Cycle | | | | | Bitcoin (BTC) miners are learning the hard way that "numbers go up" doesn't always trickle down. Even with Bitcoin prices still elevated by historical standards, mining margins have been sharply squeezed, with some industry analysts describing the current climate as the "harshest margin environment" on record. Balance sheets are shrinking, leverage is being reduced, and companies such as CleanSpark are moving to pay down Bitcoin-backed credit lines. The strain is spilling into public markets. Bitcoin miners and other BTC "proxy" trades have come under heavy pressure, highlighted by the collapse in shares of American Bitcoin. Not every corner of the market is retreating, however. Capital is flowing into crypto-adjacent platforms, with prediction market Kalshi recently raising $1 billion at an $11-billion valuation after a tenfold increase in trading volumes since 2024, overtaking Polymarket. Meanwhile, Ether is gaining traction in derivatives markets. CME Group reports that Ether (ETH) futures volumes have recently surpassed those tied to Bitcoin, reflecting rising options volatility and growing trader interest. This week's Crypto Biz examines the intensifying pressure on Bitcoin miners, the surge in Ethereum derivatives activity and Kalshi's blockbuster funding round.

| | | | Bitcoin mining companies squeezed by "harshest margin environment of all time" Renewed volatility in the Bitcoin market has pushed mining economics into the "harshest margin environment of all time," according to TheMinerMag, which cited structurally low mining revenues driven by falling hash prices, rising operating costs and equipment payback periods stretching beyond 1,000 days as key warning signs. "Balance sheets are retracting" in response to the worsening economics, the publication said, pointing specifically to CleanSpark's decision to fully repay its Bitcoin-backed credit line with Coinbase as an example of miners moving to reduce financial risk. Bitcoin mining stocks have remained volatile in 2025 as the industry continues to adjust to the revenue shock from last year's Bitcoin halving, which cut mining rewards in half. At the same time, many miners are pivoting toward AI and high-performance computing workloads in an effort to secure more stable, predictable revenue than Bitcoin mining alone can provide.

| | | | | | | | American Bitcoin stock crashes as BTC proxy trade unravels

Shares of American Bitcoin, a mining and digital asset treasury company associated with Eric Trump, plummeted more than 50% in a single trading session this week, underscoring the extreme volatility still affecting crypto-linked equities. The stock lost roughly half its value shortly after the market opened Tuesday, extending a broader sell-off across Bitcoin mining stocks and other so-called crypto "proxy" trades that has intensified since Bitcoin pulled back from its October high. American Bitcoin shares are now down more than 75% from their post-listing high of $9.31, reached shortly after the company began trading publicly through a reverse merger with Gryphon Mining. The steep decline underscores growing investor caution toward speculative crypto equities as Bitcoin prices and mining economics come under pressure.

American Bitcoin (ABTC) has experienced extreme volatility since September. Source: Yahoo Finance | |  | | | | | | | | Kalshi raises $1 billion as valuation swells

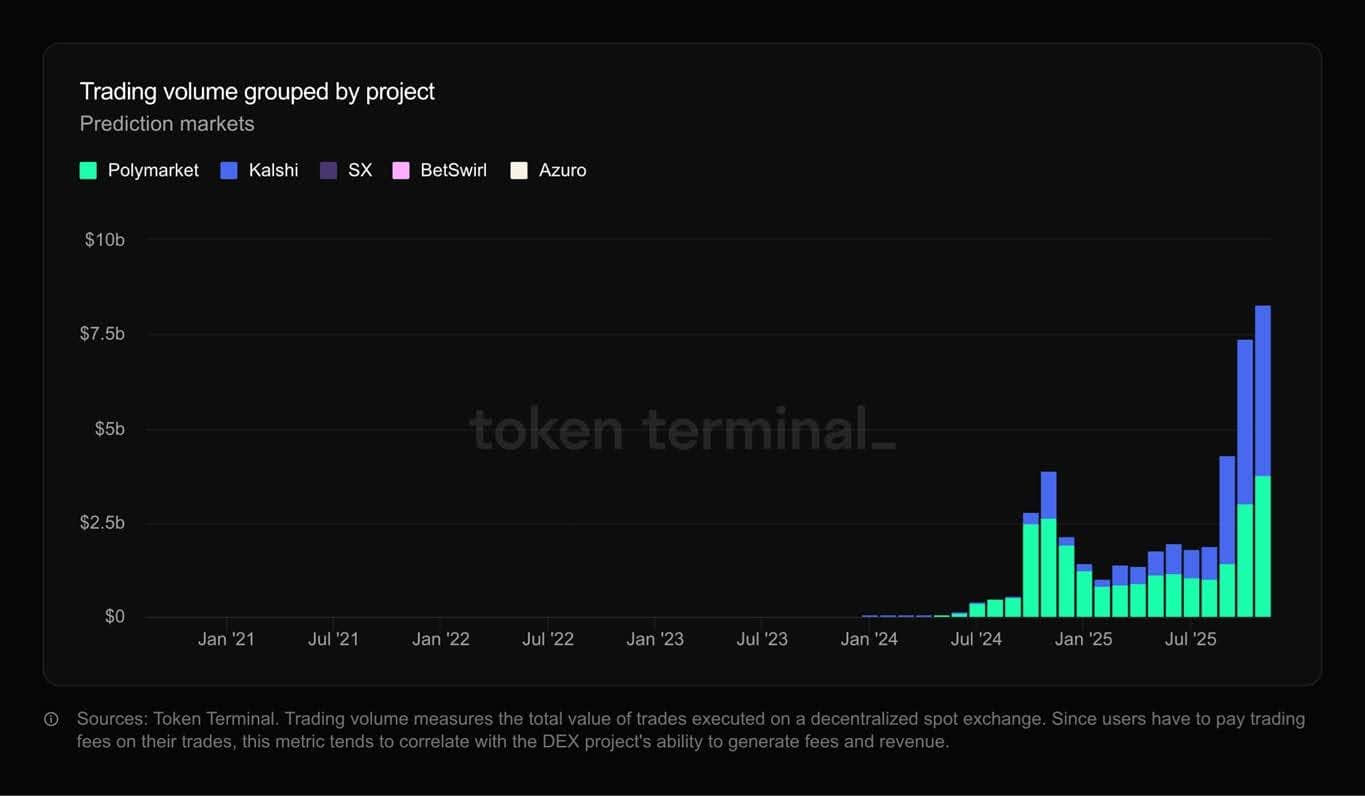

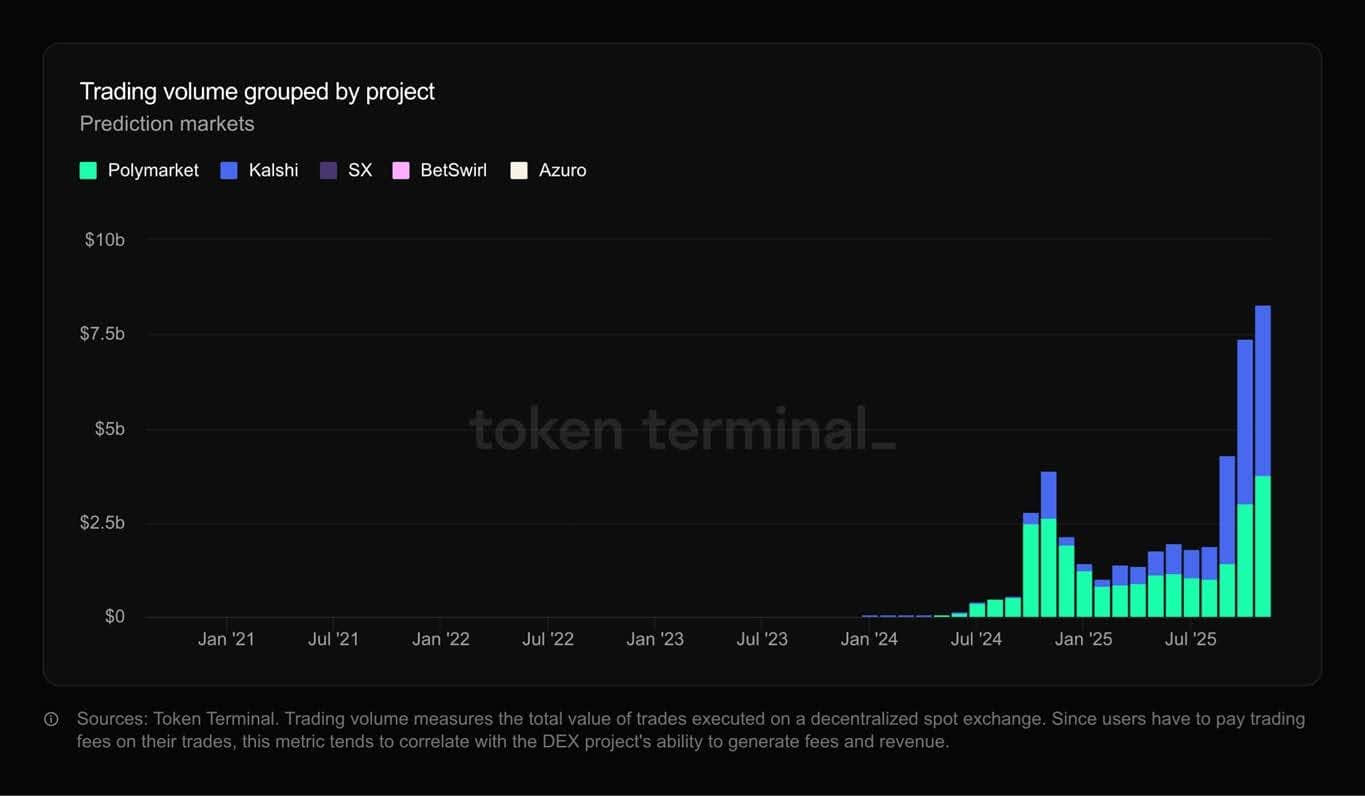

Prediction market Kalshi has raised $1 billion at an $11-billion valuation, signaling a renewed interest in event-based trading among investors. The Series E funding round followed Kalshi's strongest month on record for trading activity and was led by crypto-focused venture firm Paradigm, with participation from Andreessen Horowitz, Sequoia Capital and ARK Invest. Kalshi's trading volume reached $4.54 billion in November, surpassing its previous all-time high, according to industry data. The company stated that its trading activity has grown tenfold since 2024, surpassing rivals such as Polymarket to become the largest prediction market by volume.

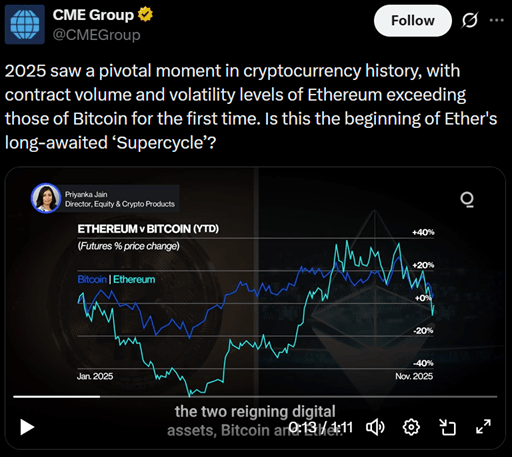

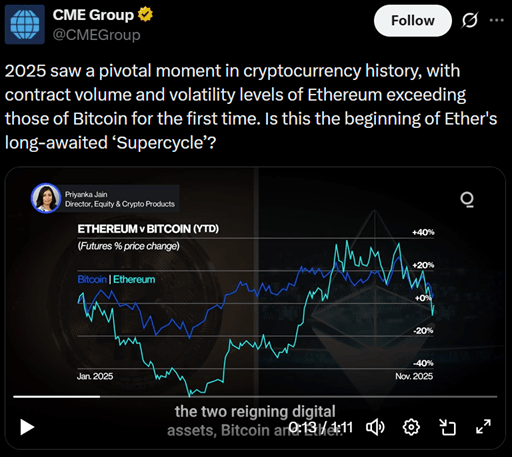

Kalshi (blue) overtakes Polymarket (green) in trading volume. Source: Token Terminal | |  | | | | | | | | CME rekindles Ether super-cycle debate CME Group has reported a sharp rise in Ether futures trading activity, with volumes recently surpassing those of Bitcoin options. The exchange said the surge may reflect a catch-up trade or the early stages of a broader Ether "super-cycle." In a recent video, CME executive Priyanka Jain stated that ETH options are currently exhibiting higher volatility than Bitcoin options, a shift that appears to be attracting increased speculative and hedging activity. "This heightened volatility has served as a powerful magnet for traders, directly accelerating participation in CME Group's Ether futures," Jain said. "Is this Ether's long-awaited super-cycle, or merely a catch-up trade driven by short-term volatility?" Earlier this week, the CME Group launched a new Bitcoin Volatility Index, along with several additional cryptocurrency benchmarks, providing traders with standardized pricing and volatility reference data.

| |  | | | | | | | | |

Crypto Biz is your weekly pulse on the business behind blockchain and crypto, delivered directly to your inbox every Thursday.

| | | | 4.6 million people follow us on social media. You should too. | | | | | | | | | Cointelegraph Consulting Limited | | 20/F, Strand 50, 50 Bonham Strand Sheung Wan, Hong Kong

Hong Kong | | | You received this email because you signed up on our website. | | Download our official app: | | | | | | | | | | | | | | | |

0 Comments

VHAVENDA IT SOLUTIONS AND SERVICES WOULD LIKE TO HEAR FROM YOU🫵🏼🫵🏼🫵🏼🫵🏼