In partnership with |  |

|

Good Morning! |

Feature: Bitcoin 101 for SMB Owners (4 min) From the Archive:

|

-TCoL |

Missed our last feature article? The December Checklist for SMB Owners |

|

Disclaimer |

This article explains several tools and options that small and mid-sized business owners may consider when exploring Bitcoin or other digital assets. Nothing here is investment, accounting, legal, or tax advice. Digital assets are volatile and speculative. If your business begins accepting, holding, or paying with Bitcoin or other cryptocurrencies, you are adding risk that includes price movement, operational issues, regulatory uncertainty, and cybersecurity exposure. Always conduct independent research and speak with qualified professional advisors who understand your specific business and jurisdiction. This article focuses on typical United States small and mid-sized businesses. Rules can vary by state and change over time. |

|

Many business owners encounter Bitcoin in two ways. A friend insists it is the future. A customer asks to pay with it. Both conversations tend to spiral into technical arguments or price predictions. None of that helps when you are focused on payroll, cash flow, and serving customers. |

The useful version of Bitcoin is much simpler. It can act as a savings asset. It can also function as a payment rail. Everything beyond those two roles is optional. When you focus on those functions, it becomes easier to understand how Bitcoin might fit into your business and how to keep the risks manageable. |

|

Make Every Ad Dollar Work Harder |

|

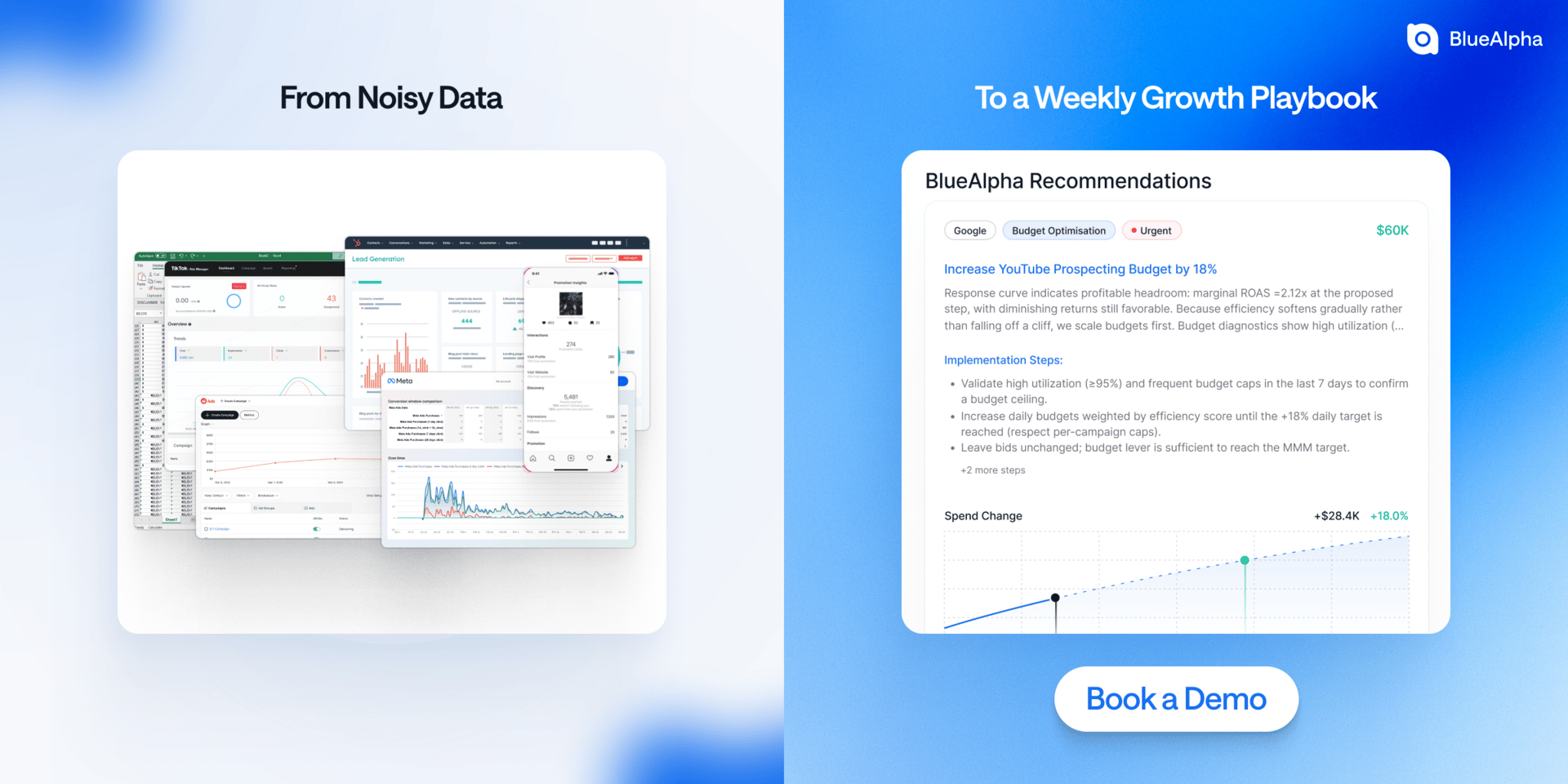

Great measurement is pointless if you don't act on it.

|

BlueAlpha is the AI Action System for Marketing, built to turn noisy data into weekly, campaign-level moves your team can actually take. Not dashboards. Not stale reports. Actions.

|

Every week, BlueAlpha delivers transparent, trusted recommendations your team can approve in minutes. Reallocate. Scale. Cap. Pause. All backed by Bayesian MMMs, causal tests, and explainable AI from the team that built Tesla's growth systems.

|

Brands like beehiiv, MUBI, and Klover, use BlueAlpha to cut waste, compound ROI, and grow faster.

|

See measurable lift in under a month. See how an action system changes everything. |

|

Focus on what matters for an SMB owner |

Bitcoin often carries cultural or investment baggage, but an SMB owner can ignore most of that. It shows up in only two practical places. |

You may want to accumulate it personally, the same way you might accumulate a small position in gold or a foreign currency. You may also want to accept it from customers or pay it to contractors. Those two areas cover almost all real-world business activity involving Bitcoin. |

Once you separate the practical from the speculative, you can decide which workflows should remain in dollars and where Bitcoin might create value without creating unnecessary complexity. |

|

If you want Bitcoin personally, start with the simplest method |

W2 wages in the United States must be paid and reported in dollars. That requirement is firm. Your payroll provider will process every part of wages, deductions, and withholding in dollars, even if the employee later chooses to convert part of their pay into Bitcoin. |

Once your paycheck reaches your account, you can convert part of it into Bitcoin through consumer apps. Several providers offer recurring purchase tools and may provide discounted or zero fee options on automatic Bitcoin purchases, subject to their current terms and limits. Providers update fees and features often, so confirm the current schedule directly. |

Some financial apps once promoted paycheck routing into Bitcoin, but most employees today rely on direct deposit followed by recurring Bitcoin purchases inside an app. If your goal is steady accumulation, use tools that offer simple recurring purchases, transparent pricing, and easy export of transaction history for tax reporting. |

|

Accepting Bitcoin from customers is easier than most owners expect |

Accepting Bitcoin once required technical knowledge and an interest in self-custody. Today the process can feel similar to accepting online payments through well-known processors. You can add Bitcoin with little change to your core workflow. |

There are three common approaches for United States SMBs. |

A. Use a payment processor |

Crypto payment processors let you accept Bitcoin and sometimes other assets. They handle pricing, generate a QR code or checkout link, and confirm the payment. You can convert the payment into dollars or keep the Bitcoin. Many owners choose automatic conversion to reduce volatility and simplify accounting. |

Fees, supported assets, and plan tiers vary and change frequently. A typical range is near one percent for basic plans. A processor is usually the easiest way for an SMB to accept Bitcoin while keeping financial statements in dollars. |

If you have used Stripe or PayPal, this workflow will look familiar. You create an invoice or checkout session, the customer pays with Bitcoin, and the processor routes your settlement into dollars or Bitcoin depending on your configuration. |

B. Use BTCPay Server if you are technical |

BTCPay Server is open-source software that businesses can run themselves. It charges no platform fees and allows full control of any Bitcoin received. You will still pay network fees and any hosting costs. |

This option requires someone comfortable with installation, security, backups, and updates. If you have that capability, BTCPay offers maximum control at low ongoing cost. If not, a processor will be safer and more practical. |

C. Add Bitcoin to your existing invoice workflow |

Service businesses that invoice clients can add a Bitcoin option without changing their core process. Many wallets generate a payment request with a Bitcoin address and amount. You can share that request with clients by link or QR code. |

Record the fair market value in dollars at the time of receipt. Decide whether you will convert the Bitcoin into dollars or hold some portion. A simple written rule helps your team stay consistent. |

|

Get tools that work as hard as you do.

The Co. Letter Premium gives you instant access to a growing library of proven templates designed to help you and your LLC save time, improve cash flow, and protect your business. All are professionally prepared.

|

|

|

|

|

Paying employees or contractors in Bitcoin |

This is the area where compliance matters most. |

W2 employees in the United States must be paid in dollars, including withholding and employer payroll obligations. Your business should run payroll entirely in dollars. Employees who want Bitcoin can convert a portion of their net pay through a consumer app that supports recurring conversions. This structure keeps your business compliant while giving employees flexibility. |

Independent contractors follow a different framework. A business may pay a contractor in Bitcoin, but it is prudent to confirm specific details with advisors. Many owners denominate the contract in dollars and pay in Bitcoin at the prevailing market rate at the time of payment. You then record the dollar value at payment for your own records. |

Bitcoin is treated as property for tax purposes in the United States. Paying a contractor with Bitcoin may create a taxable gain or loss for your business if the value changed between acquisition and payment. The contractor recognizes income equal to the dollar value received and then tracks any later gain or loss when they spend or sell the Bitcoin. |

Several platforms facilitate contractor and vendor payments. They can support Bitcoin, stablecoins, and often local currencies. These platforms reduce manual work and help with documentation, but you must still confirm how each one handles compliance and fees for your situation. |

|

Should your business hold Bitcoin |

Some businesses hold a small percentage of reserves in Bitcoin as a long-term speculative asset. Others avoid it entirely. Both choices are reasonable. |

Bitcoin can appreciate quickly. It can also fall sharply. Any allocation should be modest and treated as speculative. Many conservative treasuries keep most reserves in cash or cash equivalents and hold only a small position in Bitcoin, reviewed periodically rather than daily. |

Holding Bitcoin also introduces extra accounting and tax tracking. Cost basis must be recorded. Unrealized changes in value must be monitored. Gains and losses must be calculated when Bitcoin is sold or used. If you decide to hold Bitcoin, work with an accountant who understands digital assets under current United States rules. |

|

A simple Bitcoin setup for busy United States SMB owners |

A conservative structure can fit most small businesses. |

For personal accumulation, choose a reputable consumer platform that offers recurring purchases, clear pricing, and easy download of transaction history. Set a modest recurring purchase and avoid constant adjustments. |

For customer payments, use a payment processor that displays prices in dollars, accepts Bitcoin at checkout, and converts receipts into dollars unless you intentionally choose to hold a portion. If you want full control and have technical help, consider BTCPay Server. |

For contractor payments, consider a platform that supports crypto payouts and provides helpful documentation. Denominate contracts in dollars and pay in Bitcoin at the market rate at that moment. Keep clear records for each transaction. |

For bookkeeping, record every Bitcoin receipt at its dollar value at the moment you receive it. Keep your primary accounting system in dollars. Track Bitcoin balances, cost basis, and dispositions separately. |

Simple, repeatable rules offer more value than complex allocation schemes. A consistent process protects your time and keeps your business organized. |

|

Be a cautious owner |

Bitcoin does not require enthusiasm. It rewards consistency and awareness of risk. |

If you want to own Bitcoin personally, consider automating small purchases. If you want to accept it from customers, use a reputable, proven processor. If you want to pay contractors globally, choose a proven platform that handles most of the operational complexity. |

Bitcoin then becomes what it should be for a cautious business owner. A modern tool attached to a simple set of rules. |

If you ultimately choose to use it, pair any Bitcoin exposure with sound cash management, reliable security practices, and advice tailored to your business and jurisdiction. |

|

|

|

TaxElm: Want to keep more of what you earn? Our tax strategy system helps entrepreneurs and business owners legally reduce their tax burden. Download our free Tax Savings Starter Kit or book a discovery call with Matt Grimmer from our team. |

|

Have an interesting business question and need a free bit of advice? Send your question to ops@thecoletter.com. No confidential info, please! |

0 Comments

VHAVENDA IT SOLUTIONS AND SERVICES WOULD LIKE TO HEAR FROM YOU🫵🏼🫵🏼🫵🏼🫵🏼